Aliens of dollars are lost every year to fake tax returns it's a cybercrime constantly on the rise team tens Melissa maseeha shows us just how easy it is for somebody to steal your tax refund in this consumer report newsradio 600 cal go Sully hear talk show host Sully is a victim of identity theft he went to file his taxes a few weeks ago he called the IRS to ask a question and was told this you've already filed a tax return and you've received your refund he's not alone radio personality delena Bennett from star 94 1 got her money stolen too I had to wait over a year to get anything settled with the IRS millions of Social Security numbers were stolen last year with the recent anthem health security breach millions more could be vulnerable and unfortunately steven cobb a cybersecurity expert with ESET says this crime will just get more popular they put in phony w two numbers that show they are owed a refund and the IRS will pay the refund and then when you go to file using your social security number if somebody's already done this for you you don't get your refund you you get a lot of paperwork between 2025 in 2025 the IRS stopped 63 billion dollars worth of fraudulent tax refunds but it paid identity thieves 5.2 billion in 2025 alone not the the computer filing which is broken it's the checks and balances within the IRS that are broken it was a huge time suck I'm talking hours and hours and hours there is extra security a six digit pin for helping the IRS protect your identity when you file taxes but it's only available for fraud victims and residents of Florida Georgia and DC the...

Award-winning PDF software

Irs identity theft contact phone number Form: What You Should Know

IRS's website, TaxA ct.gov, offers comprehensive online guidance for taxpayers across the globe. A full page of helpful tips to help prevent and report scams. Read IRS Guidance on Tax Scams to Determine If You're Being Scammed and to File a Complaint. Tax-related Identity/Taxpayer Fraud — IRS Identity Protection The IRS Identity Protection Specialized Unit at, extension 245 provides information to the public about identity theft and about the steps a victim can take to protect his or her identity.

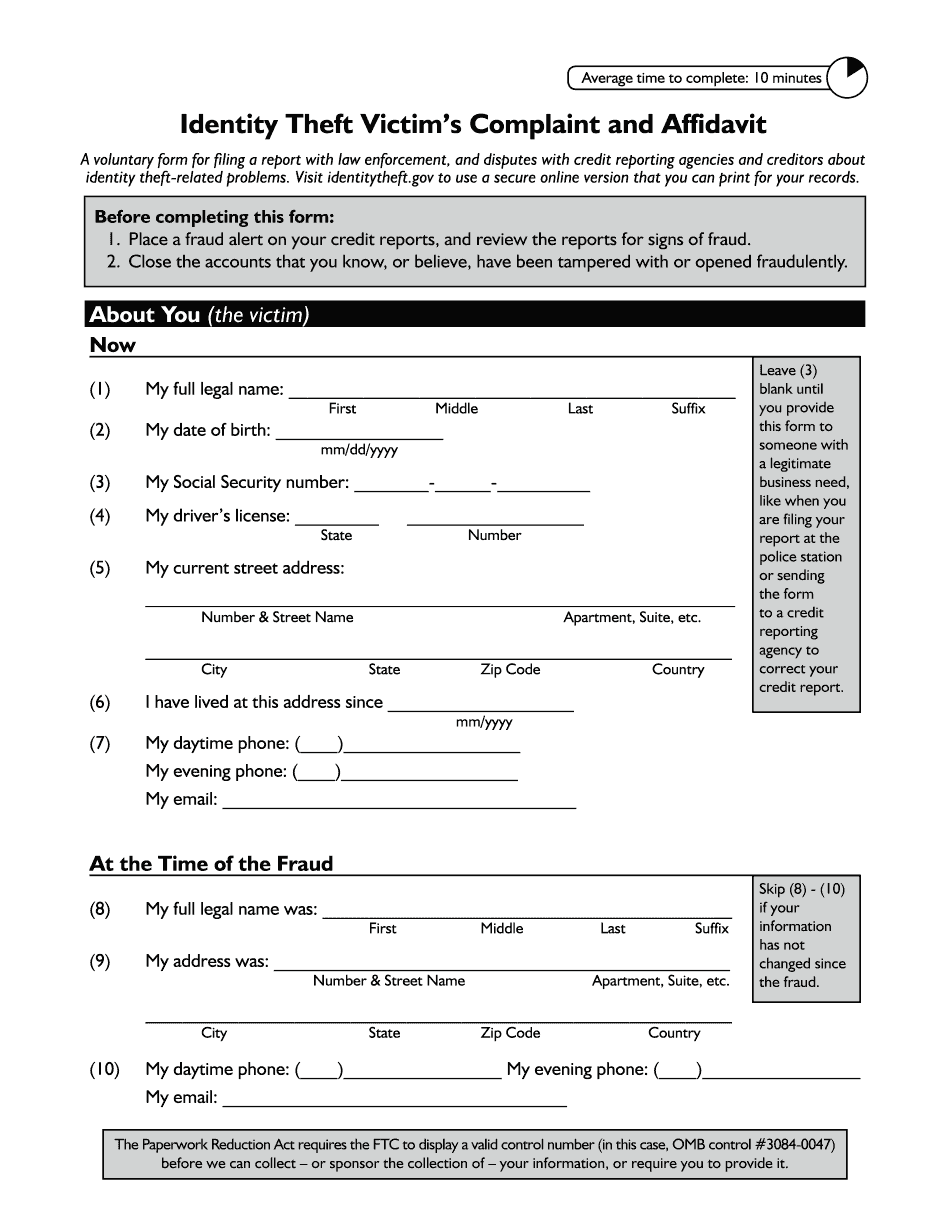

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ftc Identity Theft Victim's Complaint And Affidavit, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ftc Identity Theft Victim's Complaint And Affidavit online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ftc Identity Theft Victim's Complaint And Affidavit by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ftc Identity Theft Victim's Complaint And Affidavit from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs identity theft contact phone number