My grandson Wayne has always been good to me. He's such a good boy. He brings me groceries and takes me shopping. He recently graduated from high school and I wanted to get him a special graduation present from his grandmother. That's when I decided to go to the bank and apply for a loan to buy him his very first car. So, I made an appointment at the bank. I thought there wouldn't be any problems since I have been dealing with that bank for over 40 years. I went to see the loan manager, Kathy, as she looked up my file on the computer. I was telling her all about Wayne when her expression suddenly became serious. I started to worry because I couldn't imagine having any issues with the bank. She said, "It says here that you have an outstanding debt." I couldn't believe what I was hearing because I have never had a credit card in my entire life. I had never even heard of a freedom credit card. She continued, "Well, it says here that you have one and there is a $28,000 outstanding debt." I was completely shaken and didn't know how to respond. She then kindly got me a cup of coffee and we chatted about the situation. Kathy suggested that I go to the police station, suspecting that someone had stolen my identity and used it to obtain a credit card without my knowledge. So, worried all the way there, I drove to the police station. I was afraid they wouldn't believe my story or worse, arrest me. However, I was relieved to meet a very nice detective who took my case. He wrote down all the necessary information and I went back home. About two weeks later, the detective contacted me and said he wanted to...

Award-winning PDF software

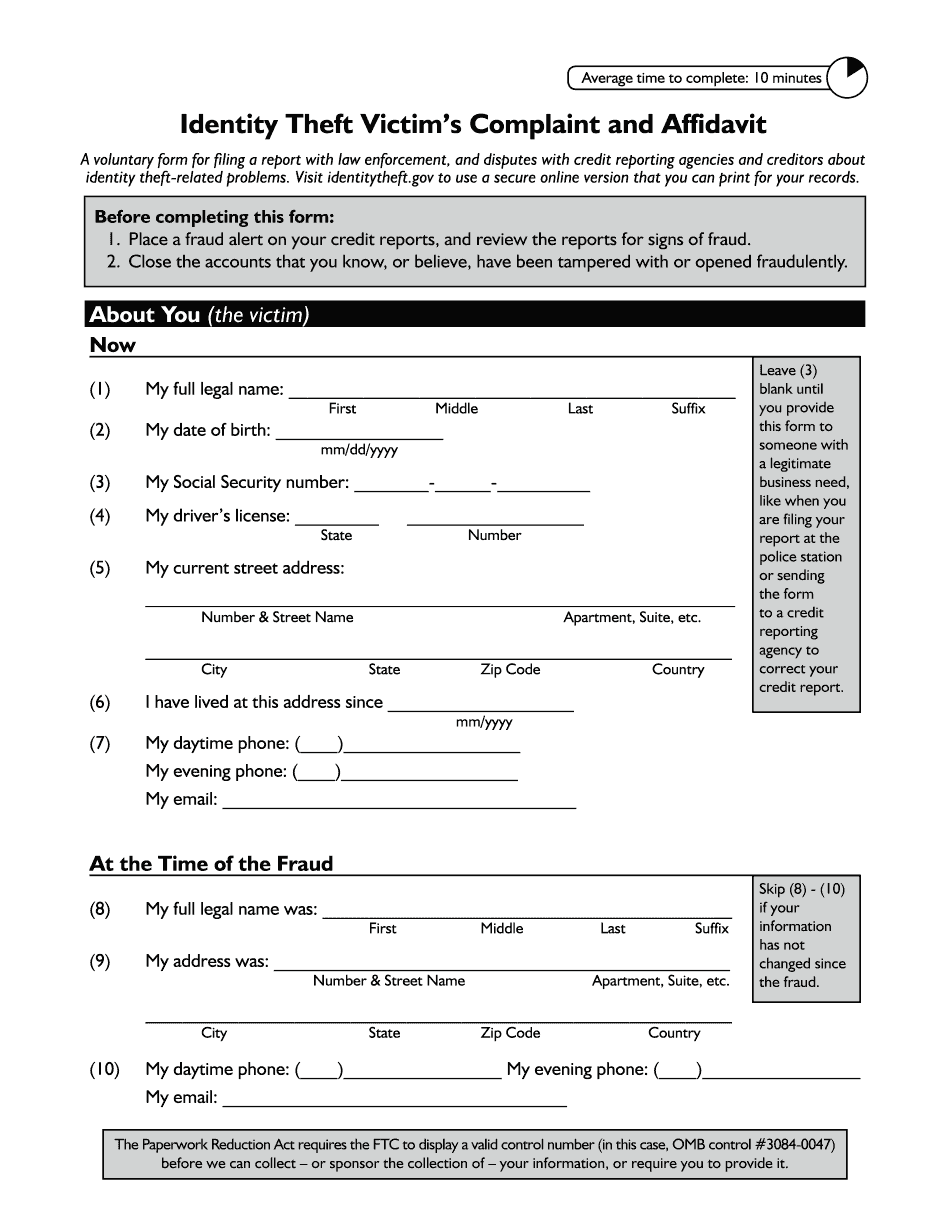

Identity theft victim Form: What You Should Know

Contact the Attorney General A report of a credit file, a fraudulently obtained credit or identity theft report, or other data that might be relevant for an investigative or law enforcement purpose; provided that a report has not been sent to the Federal Trade Commission or a state or local government. A report should include all identifying information such as the name or driver's license of anyone who is involved in or may be the subject of a complaint; if a file or report has been requested by an agency, the agency may need additional identifying information. The filing of a case or request will not prohibit the filing of a separate complaint or report later. Also, to request a copy of a report to be referred to a law enforcement agency, you must complete the following form (see for more detailed instructions): ID THEFT REPORT — FORM ID_R_03.pdf This document is only for use when the credit information is not available. The information on this form will determine if the file is opened for examination under the Identity Theft Act. IdentityTheft.gov An online system for filing reports of identity theft. IRS Form 14039 — Affidavit of Loss of Identity Theft This information is provided to you as a convenience only. It does not constitute legal advice. Your use of this form is entirely at your own risk. IdentityTheft.gov A Federal agency that may conduct a criminal investigation and prosecute a case of identity theft or fraud against a taxpayer when you submit a federal Form 14039 with a complaint based solely on what you know about the victim's personal information. IdentityTheft.gov This web address is provided to you as a courtesy and does not constitute legal advice.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ftc Identity Theft Victim's Complaint And Affidavit, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ftc Identity Theft Victim's Complaint And Affidavit online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ftc Identity Theft Victim's Complaint And Affidavit by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ftc Identity Theft Victim's Complaint And Affidavit from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Identity theft victim