If your identity has been stolen, the first thing you should do is file a police report. After that, you should visit the FTC's website and fill out the form under identity theft. The form is laid out in a very organized manner, and you can also fill out an affidavit swearing that this has happened to you. This will help you create an identity theft package. Once these steps are completed, you need to contact the credit bureaus and request a fraud alert on your credit. This fraud alert will last for 90 days, but it is crucial to have it done immediately to prevent further transactions under your identity. After the fraud alert, you should reach out to each trade line that has been affected by the identity theft. Inform them about the situation and ensure they are aware of what has happened. It is essential to call your credit card companies as well and let them know about the incident. They may advise you to acquire a new credit card, and in some cases, they may issue you new cards. If the theft involves your checking account, your bank may close the account for you and open a new one with a different routing number. For any accounts that belong to you but have been compromised, you will need to go through the dispute process to resolve the issue. Throughout this process, it is vital to stay organized. Make a list of all the occurrences, keep a file, and note down contact names and information from the companies claiming you owe them money for things you didn't purchase. Stay in touch with them and find out what steps you need to take. Gather all the necessary documents, such as copies of your police report and ID theft affidavit. Be prepared for...

Award-winning PDF software

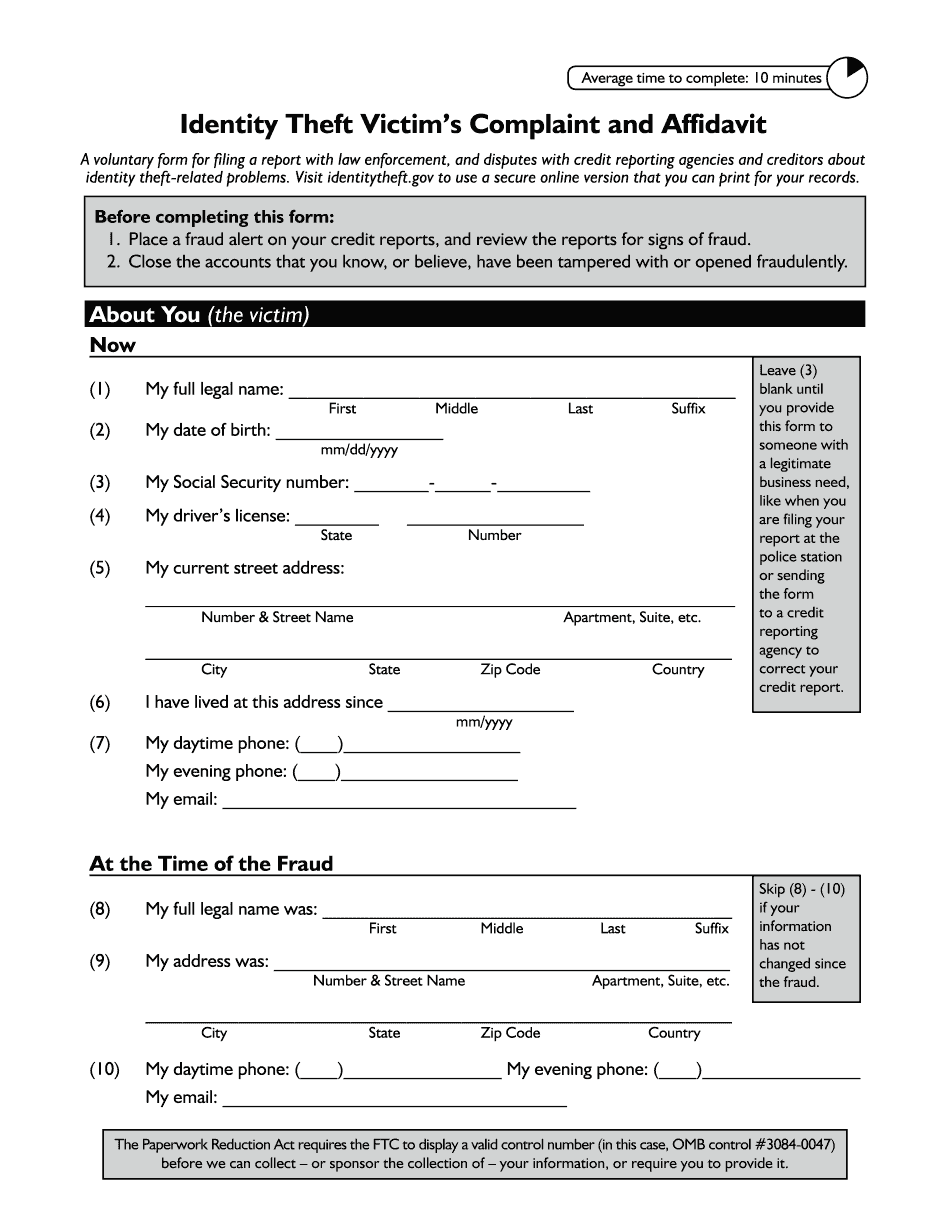

Ftc Identity Theft Form: What You Should Know

Affidavit to Law Enforcement and Consumers An affidavit for a law enforcement report is a written form, used to certify an individual's identity for purposes of the federal Fair Credit Reporting Act and other Federal laws. The identity theft affidavit provides an Identity Theft Report to Law Enforcement A law enforcement affidavit provides a consumer report and a statement of a reason why the information is sought from an institution.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ftc Identity Theft Victim's Complaint And Affidavit, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ftc Identity Theft Victim's Complaint And Affidavit online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ftc Identity Theft Victim's Complaint And Affidavit by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ftc Identity Theft Victim's Complaint And Affidavit from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ftc Identity Theft