Unfortunately, in this day and age, cybercrime and identity theft are just something that it seems like we're going to have to live with for the indefinite future. The IRS recognizes this and has taken steps and precautions to definitely increase security and expectations on everybody across the board to help in that effort. One of the things that they did was implement the IP pin (identity protection pin). I know that they were heavily distributed in South Florida, parts of Texas, Tampa, and other areas throughout the country. It caused major problems the first year that they came out, but now everybody seems to understand it and it's becoming commonplace in our lives. So, where is the IP pin located and how do you fill it out? The taxpayer will receive a letter with the pin inside. They need to come over to the federal section, click on miscellaneous forms, and find the IEP pin (identification pin) form. They need to populate the form with the pin for all individuals within the tax return. If someone else on the return also has an IP pin, it is required to be filled in with the six characters. Leaving it blank when an IP pin is issued will cause the return to be rejected. It's a really simple scenario on how to input that information, and hopefully, now you don't have to look for a dream taxi and you know where it's at. Thanks so much.

Award-winning PDF software

Irs identity theft pin Form: What You Should Know

The IRS may send you a PIN within the next 60 or 90 days after you request one, and then it will be e, dictated to you to fill out and return to the IRS before completing your return. A2: When using online tax preparation software, enter the IP PIN only once. Do not use the IP PIN in more than one tax return. A3: If you need to replace your IP PIN, contact your sales representative or ask for the help of your nearest U.S. postal service branch. A4: If you cannot locate your IP PIN, ask for assistance from the Taxpayer Advocate Service in the following locations: Identity Theft — Identity Theft- IRS A5: If your PIN expires, you can have the IRS send you a new one by mailing the new PIN to the address above. If you have forgotten your PIN, use this Form 845 to request an ID protection PIN. A6: If you have lost your IP PIN, then request one from the IRS's Identity Protection Bureau at the address above or call and an Identity Protection Specialist will help you get a new PIN. A7: For additional information, visit IRS.gov/idppin or call. A8: The IRS is pleased to continue to increase the number of tax filers who submit a Form 1543 electronically, for filing for the first time, and providing taxpayers with additional assistance and information each year. Form 1543 includes the option to send a second copy to the IRS for one free copy of Form 1040X (tax return) or 1040XA (account information) with an IP PIN. The additional IP PIN will be issued only if additional information is required to meet one of the reasons for filing a return online such as Form 1040X or 1040XA being filed for the first time. A9: Your IP PIN is unique to you. It cannot be shared or disclosed to anyone else. When providing your IP PIN, if you are under 18 years of age, you must notify your parent(s)/legal guardian or get the permission of your parent/legal guardian.

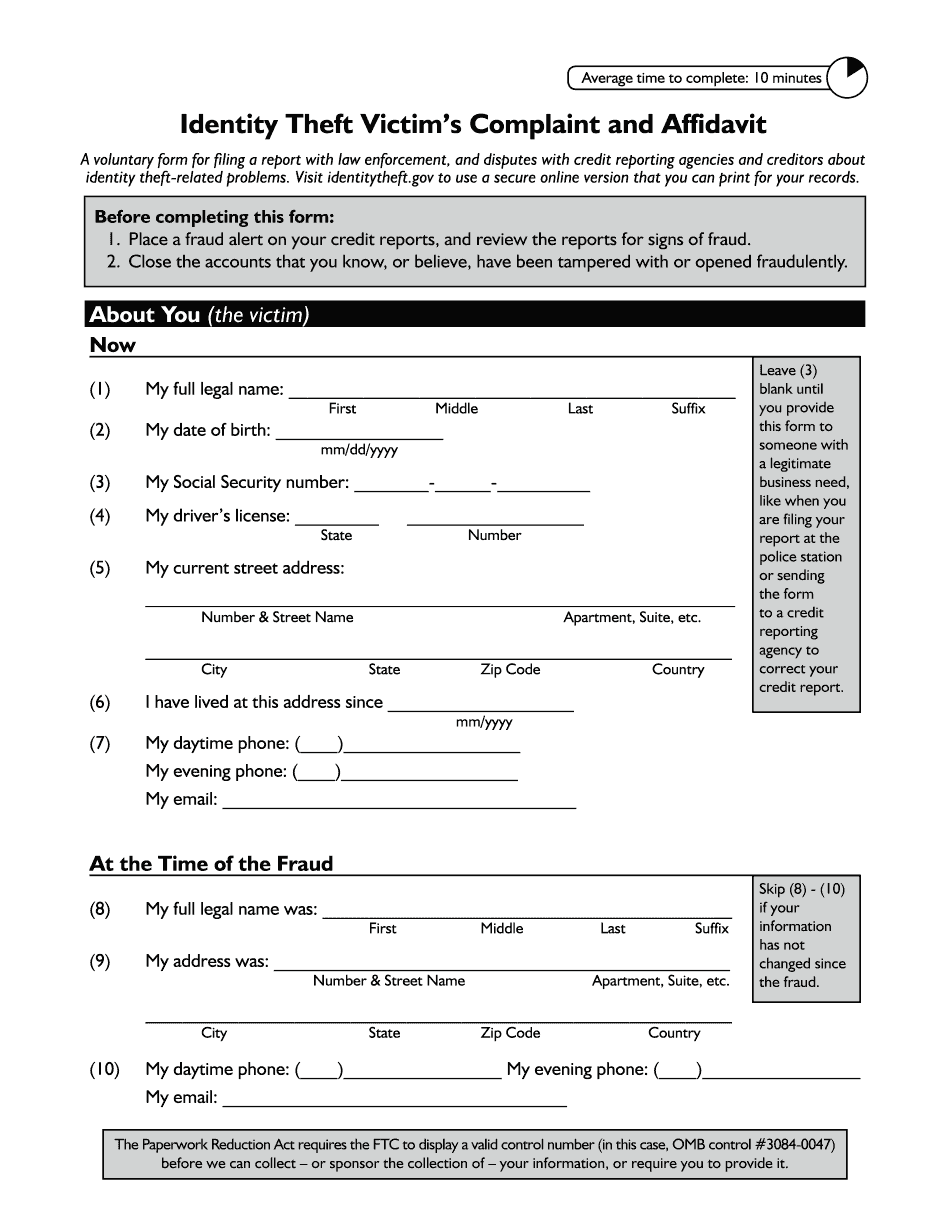

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ftc Identity Theft Victim's Complaint And Affidavit, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ftc Identity Theft Victim's Complaint And Affidavit online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ftc Identity Theft Victim's Complaint And Affidavit by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ftc Identity Theft Victim's Complaint And Affidavit from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs identity theft pin