There have been lots of stories over the past few months on identity theft, and how the information can be used against you. You may have heard something about stolen identity tax fraud, or you may even have been a victim of it. It's the biggest tax scam around right now, as we first reported in September. This is how it works: someone steals your identity, files a bogus tax return in your name before you do, and collects a refund from the IRS. It's so simple, you would think it would never work, but it does. It's been around since 2008. You would think the IRS would have come up with a way to stop it, and it has. Instead, the scam has gone viral, tripling in the last three years. The government says it's affecting millions of Americans and costing taxpayers billions of dollars every year, proving once again what every good con man already knows: there is no underestimating the general dysfunction and incompetence of government bureaucracy. It's a tsunami of fraud. We have been encountering a vast number of fraudulent tax returns. It's something that I don't think the IRS ever really was ready for. Wilfredo Ferrer is the United States Attorney for southern Florida, and George Piro is the agent in charge of the Miami field office of the FBI. Together, they run a federal task force operating at the epicenter of the largest tax scam in the country. Florida has been in third year in a row on the top number one in terms of ID theft complaints, and Miami is also number one in terms of metropolitan areas that suffer from identity fraud. Don't take this the wrong way, but is there any scheme that Miami is not number one at? We have...

Award-winning PDF software

Irs identity theft refund status Form: What You Should Know

Identity Theft Resource Guide Identity Theft Resource Guide May 10, 2025 — The identity thieves will contact you if you are in their network and threaten to send your tax return to your creditors if you don't pay them. Identity Theft Tax Fraud Fact Sheet May 10, 2025 — This fact sheet helps educate all taxpayers about the identity theft tax scam. Online tax scams can pose a financial harm to both individuals and the taxpayer, as the taxpayer inadvertently pays money from their own funds to the crooks and then never receives it back. A complete scam involves thieves using the “Tax Identification Number” of another individual to obtain a tax refund from the IRS, usually in the form of cash. The scams are perpetrated by criminals who can take as many as several thousand dollars from unsuspecting victims by using taxpayer's personal information (including personal identifying information such as Social Security numbers, information about their banking accounts or credit card balances) to file fraudulent tax returns. The scammers are generally unsophisticated criminals who seek to make money through the use of stolen credit cards or bank accounts. Scammers will often claim that they need personal information (such as an SSN or tax ID number) from the taxpayer to receive a refund. This information is typically provided when the person is making a tax payment to the IRS, which provides the criminals with an opportunity to obtain cash. Fraudulent tax refund schemes, commonly referred to as tax refund scams, have been reported to the IRS in the United States, Canada, Brazil, Mexico, Thailand, Singapore, Australia, New Zealand and the United Kingdom. The IRS does not verify the validity of or authenticate tax returns submitted by potential victims. In the case of fraud, fraudulent refunds can pose significant financial harm to the taxpayer. The IRS can collect a tax refund on a credit or debit card using the taxpayer's identification number on file with the bank or credit union where the person's account is maintained; however, the IRS does not use this information to identify the (payer) of a refund. All tax refunds received by the IRS are processed according to the normal payment processing procedures described under the Internal Revenue Code. If someone attempts to request a refund, it shows the IRS is aware of the scheme and works toward preventing such activity. Once they receive a notice of refund fraud, many taxpayers simply call back to cancel the order or to ask questions about the refund.

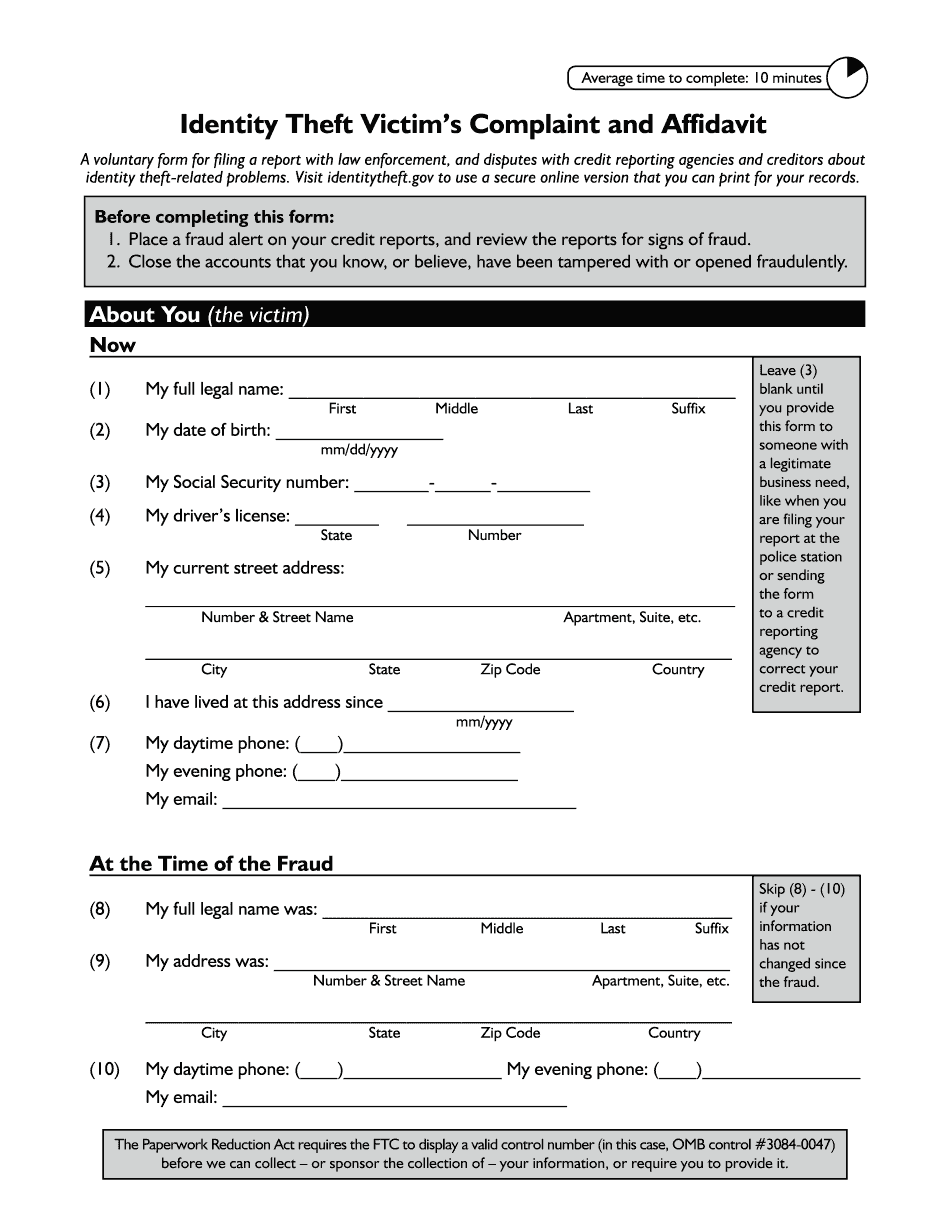

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ftc Identity Theft Victim's Complaint And Affidavit, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ftc Identity Theft Victim's Complaint And Affidavit online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ftc Identity Theft Victim's Complaint And Affidavit by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ftc Identity Theft Victim's Complaint And Affidavit from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs identity theft refund status