Man claims his identity was stolen when he applied for a job at a local company. Now he wants answers. The victim says he never got the job, but another man did using his name, social security number, and birthday. Ritika Day joins us now in the studio with that story. Freda James. Matthew Chandler says he's been waiting on employment for a while now. He says he's angry that another man was not only able to find a job but to do so using his information. This is James Matthew Chandler, and this is a man who claims to be Matthew James Chandler. Both men applied to work at JC Potter's sausage company. James Chandler was given paperwork to show that this man applied for the job using his name, social security number, and birthday. "We got a letter in the mail from DHS saying that my food benefits were going to be cut off if we didn't give them the information about my employment status, how much I was making," but Chandler says he never got the job, so he knew something was wrong. Turns out, Matthew Chandler had been an employee at JC Potter's for months. Chandler believes the man may have been an illegal alien using his information to live in Durant. Chandler and his wife contacted Durham Police and the Sheriff's Office and filed a report, but law enforcement says there is little they can do. "A police officer told the lady there that she needed to not say anything to the guy so that they could come back and arrest him, and as soon as he came into work, they told him what was going on, and he left." Chandler says so far he does not believe the identity theft has affected his credit, but...

Award-winning PDF software

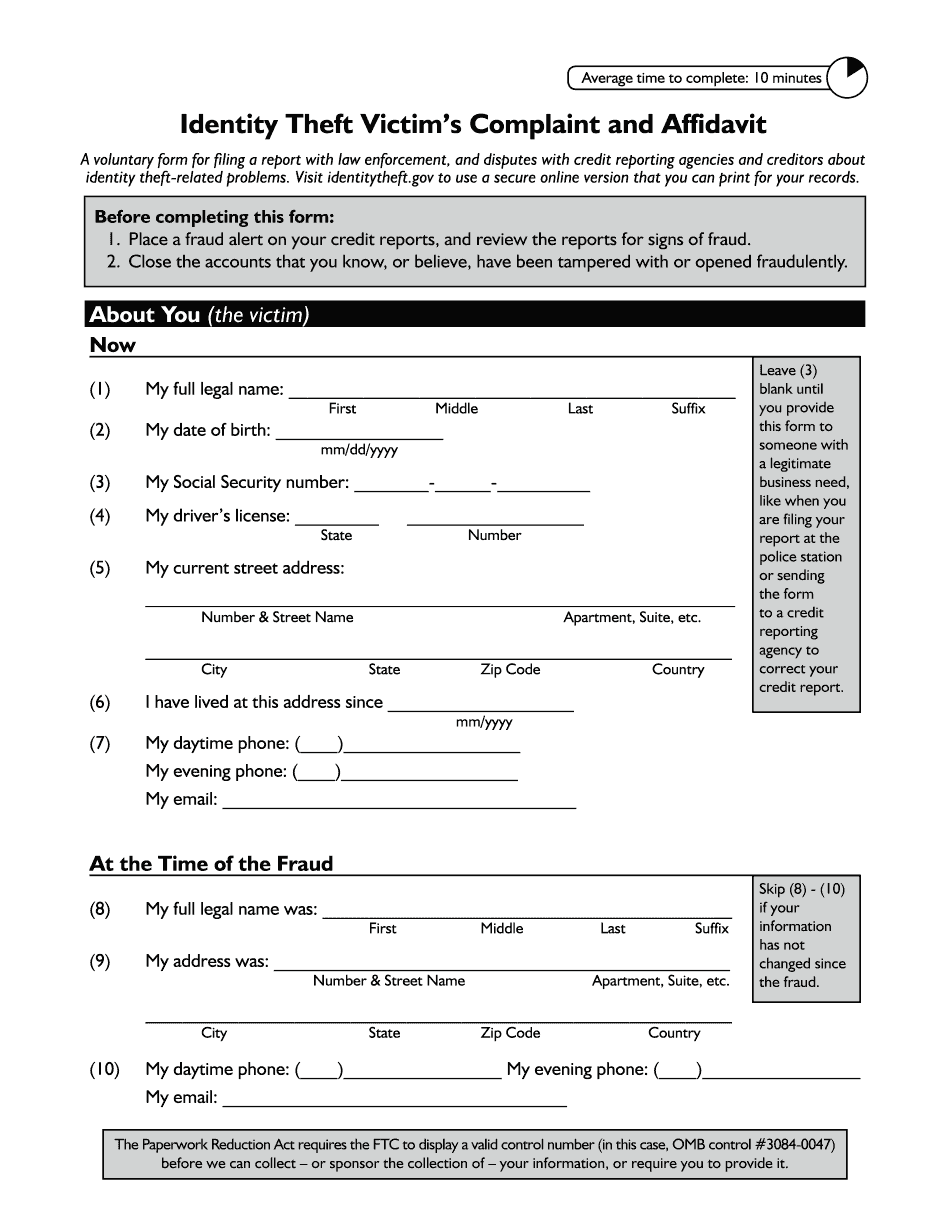

Identity Theft Affidavit instructions Form: What You Should Know

The Form 14039 form should be completed and printed on separate pieces of paper or in a blank document. Fill and sign all the required fields. When you complete and sign this form, you will be provided with the information required by the Internal Revenue Service to validate the incident. In the case of identity theft, IRS will use the report number which is found on the form, or the identification number obtained from an IRS Form 13868, Suspicious Activity Report, to validate the theft. The identity of the taxpayer to whom the identity theft occurred is required if they are filing a federal return, or will be. If the report shows that an identity theft is suspected, then this can be verified using IRS Form 14039. If you believe that the identity theft is not criminal in nature, and if the identity thief used the Social Security Number of the victim, then they can request that you contact them and they IRS Form 14039. How to file form 13027, Identity Theft Affidavit. To file a Form 13027 affidavit, enter the address of the victim's last known place of residence, and complete the appropriate sections of IRS Form 13027 Affidavit Required by IRS: This form helps the IRS detect fraud. It is a document that allows an owner of a stolen business or individual to establish his or her identity. You must file this form if you know that an identity theft occurred. What to include on your form. Fill out section B. Check the box for “Pursuant to Title 26, Unfair Competition and Consumer Protection Act,” and enter the name of each organization that you believe you stole from. Provide them with your business or individual identification number. The “Pursuant to Title 26, Unfair Competition and Consumer Protection Act” means that if this information is reported to the IRS, the identity thief will lose any protection that his or her stolen property had and may be found guilty of fraud. Make sure that you enter your full street address. If you filed an amended return and were listed using a different street address, the corrected return must be filed with your amended return and the form will be corrected when it reaches you. The IRS allows you to file this form electronically. There is no need to mail the form or attach a fee. Fill out section C by entering your Social Security information if you do not know the status of your SSN.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ftc Identity Theft Victim's Complaint And Affidavit, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ftc Identity Theft Victim's Complaint And Affidavit online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ftc Identity Theft Victim's Complaint And Affidavit by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ftc Identity Theft Victim's Complaint And Affidavit from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Identity Theft Affidavit instructions