Award-winning PDF software

Identity Theft Victim's Complaint And Affidavit fillable Form: What You Should Know

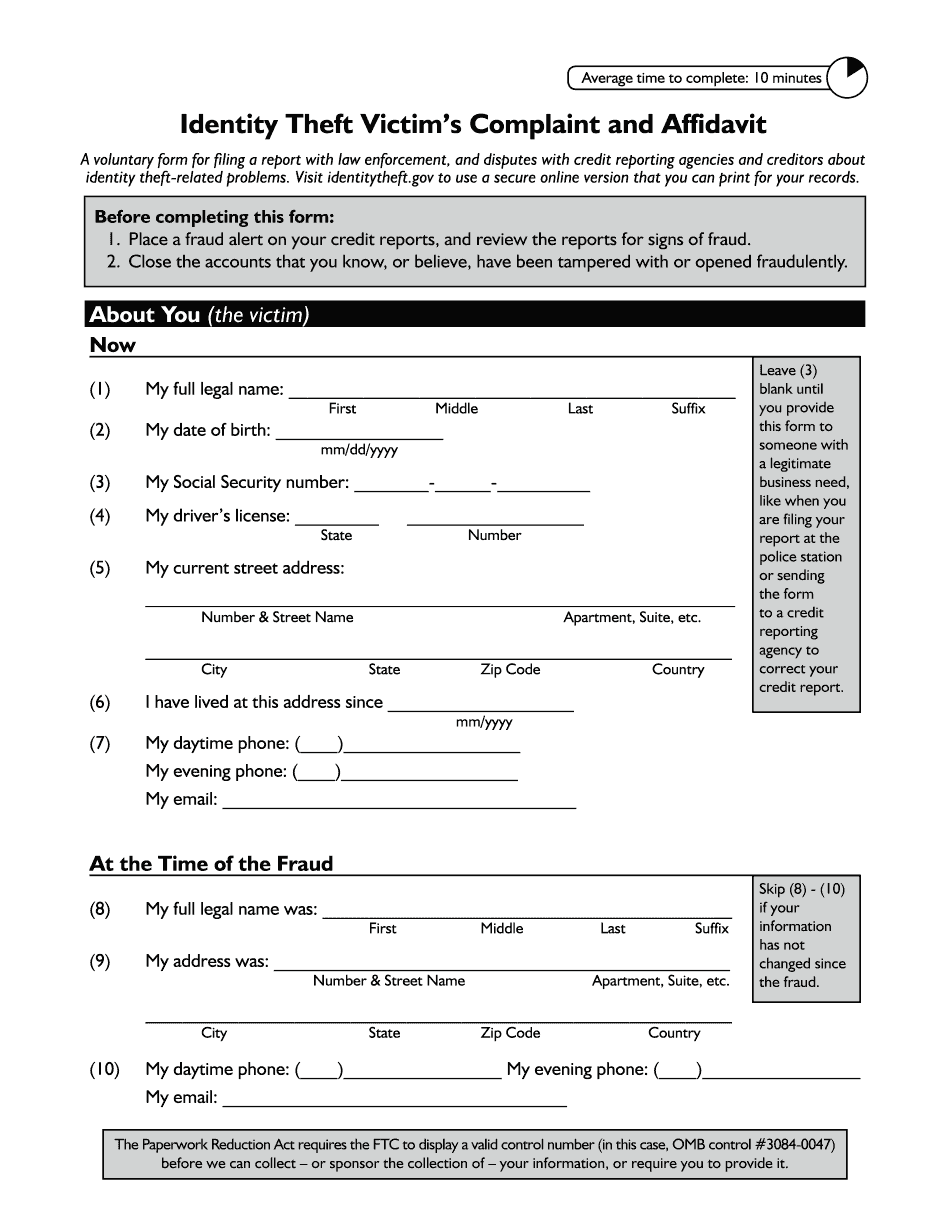

Find your form online, fill it out online or download to your printer here: IRS Forms 14039 (I-401) and 14039-EZ (I-402) Please print the forms, fill in the appropriate sections by hand. A person may make a complaint to the agency if it is satisfied the identity theft occurred; The agency has received information from a financial institution or credit reporting agency; or the agency has reason to suspect an identity theft has occurred. An employee may lodge a complaint of the commission of a crime by an employee or agent. The agency shall conduct an investigation of the complaint and determine if there has been a violation of the laws relating to civil remedies for fraud/identity theft, misappropriation of public funds or theft of trade secrets by the employer, by an employee or agent, or by any person associated with the complaint (if not a crime). Please print and fill in the below form and mail to the Identity Theft Information Center at: U.S. Consumer Finances — Identity Theft Information Center — P.O. Box 55433 — Washington, D.C. 20115 Please do not use forms for consumer disputes concerning identity theft. You should use the following forms to file a complaint with law enforcement about identity theft, not for disputes about credit, debit, or debit card accounts. The following forms are for filing complaints under the Identity Theft Prevention Act: Cite Form 14029 (I-402) and 14022 (I-401) in your complaints. An employee may lodge a complaint of this commission to the agency if: Is you make these forms you may share them here. If you would like to learn more on how to respond to identity thieves you may take some time to watch this video. To take advantage of the tools on this site, you need to fill in a form. Fill out the form by hand. There is no need to use the checkboxes and do check boxes for your identity theft complaint and affidavit forms. The above forms must be filled in with ink. The following forms must be filled in with ink and are available for immediate or future use only Note that the IRS forms are to be filed in the proper envelope, but they can be faxed or mailed. Do not file by mail, fax, or mail with postage added. See how to file online here.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ftc Identity Theft Victim's Complaint And Affidavit, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ftc Identity Theft Victim's Complaint And Affidavit online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ftc Identity Theft Victim's Complaint And Affidavit by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ftc Identity Theft Victim's Complaint And Affidavit from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.